Table of Contents

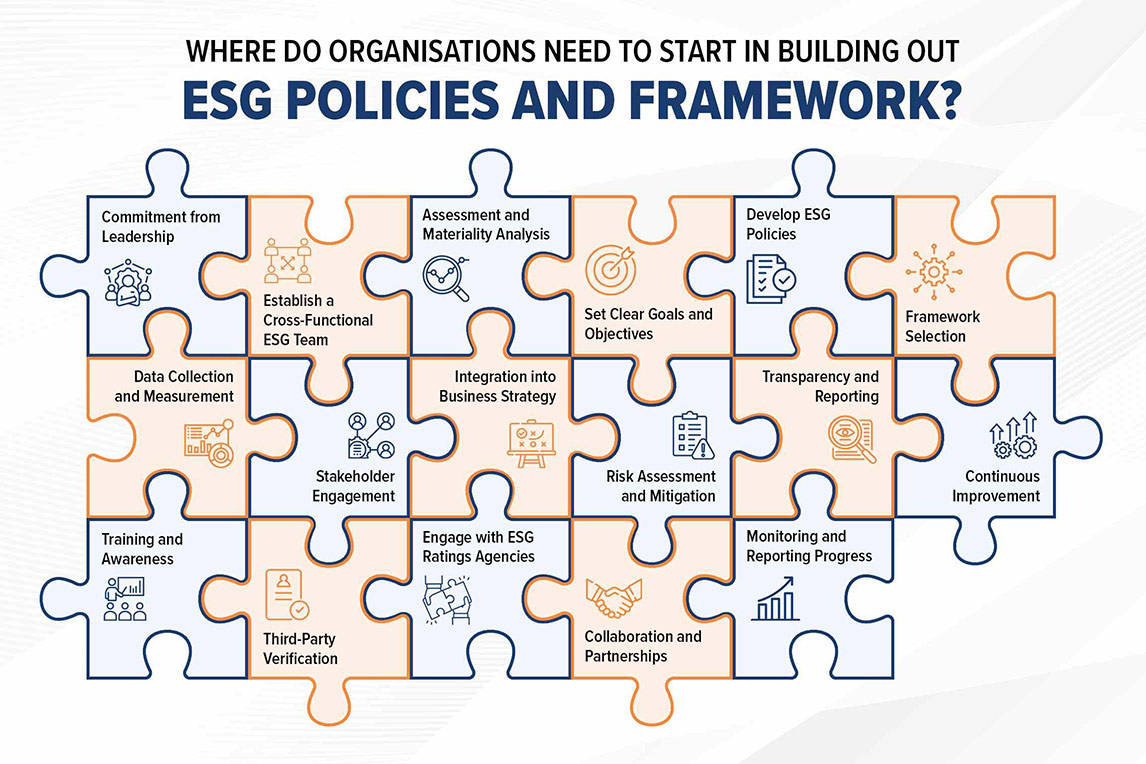

Developing comprehensive Environmental, Social, and Governance (ESG) policies and frameworks for larger organizations is a multifaceted process that entails numerous crucial steps. To provide a detailed guide, we'll explore each step in-depth to offer a comprehensive overview of the process.

- 1. Commitment from Leadership: Initiating the journey towards ESG excellence begins with securing an unwavering commitment from the top-tier leaders, which includes the CEO and the board of directors. Their support is pivotal, as it provides the necessary impetus for driving substantial change.

- 2. Establish a Cross-Functional ESG Team: The creation of a dedicated ESG team is essential. Comprising representatives from various departments such as sustainability, compliance, legal, finance, HR, and communications, this team is tasked with the development and implementation of the ESG framework.

- 3. Assessment and Materiality Analysis: Conduct a meticulous assessment aimed at identifying the ESG issues most pertinent to your organization. Materiality assessments are instrumental in prioritizing which facets of ESG demand attention and action.

- 4. Set Clear Goals and Objectives: Define specific, measurable, and time-bound ESG goals and objectives that align seamlessly with your organization's mission and values. These goals should directly address the material issues identified during the assessment phase.

- 5. Develop ESG Policies: Craft comprehensive ESG policies that articulate your organization's unwavering commitment to sustainability and responsible governance. These policies must encompass environmental, social, and governance dimensions, and outline the principles and guidelines applicable to each domain.

- 6. Framework Selection: Choose an ESG reporting framework or standards that resonate with your industry and objectives. Commonly adopted frameworks include the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), Task Force on Climate-related Financial Disclosures (TCFD), and United Nations Sustainable Development Goals (SDGs).

- 7. Data Collection and Measurement: Implement robust systems and processes for the collection, measurement, and reporting of ESG data. This may necessitate the establishment of key performance indicators (KPIs) and methodologies for data collection across each ESG category.

- 8. Stakeholder Engagement: Actively engage with key stakeholders, including investors, customers, employees, suppliers, and local communities. Seek their valuable input and feedback on your ESG initiatives and reporting processes.

- 9. Integration into Business Strategy: Ensure seamless ESG integration into your organization's overarching business strategy. ESG must be deeply ingrained in decision-making processes and risk management procedures.

- 10. Risk Assessment and Mitigation: Identify potential ESG-related risks and develop strategic measures to mitigate them. This includes a comprehensive evaluation of climate risks, supply chain vulnerabilities, social challenges, and governance issues.

- 11. Transparency and Reporting: Create a comprehensive ESG reporting framework that aligns harmoniously with your chosen standard. Consistently publish ESG reports that provide transparent insights into your organization's performance, progress, and initiatives.

- 12. Continuous Improvement: Establish a systematic process for ongoing improvement. Regularly review and update your ESG policies and frameworks to adapt to evolving priorities, regulations, and stakeholder expectations.

- 13. Training and Awareness: Implement training and awareness programs for employees to ensure they possess a deep understanding of and unwavering support for the organization's ESG goals and policies.

- 14. Third-Party Verification: Consider the possibility of obtaining third-party verification or certification for your ESG endeavors. Independent assessments can enhance credibility and foster trust among stakeholders.

- 15. Engage with ESG Ratings Agencies: Actively engage with ESG rating agencies and investors to gain a profound understanding of their expectations and requirements. Many investors rely on MSCI ESG ratings as a pivotal component of their investment decision-making process.

- 16. Collaboration and Partnerships: Foster collaborations with industry peers, non-governmental organizations (NGOs), and other entities to share best practices and collectively address ESG challenges.

- 17. Monitoring and Reporting Progress: Continuously monitor and report progress towards your ESG goals and commitments. Regularly update stakeholders on your achievements, milestones, and challenges encountered along the way.

It is imperative to recognize that ESG implementation involves an ongoing and evolving journey in building and implementing ESG policies and frameworks. Success in this endeavor hinges on a long-term commitment, unwavering dedication, and the ability to adapt to ever-evolving ESG trends and regulations. Furthermore, seeking external guidance from ESG consultants or sustainability experts can be invaluable, particularly for larger organizations characterized by intricate operations and complex reporting requirements. Embracing ESG services is not just a responsibility but an opportunity for organizations to drive positive change, foster sustainability, and create lasting value for all stakeholders involved.