Table of Contents

What is ESG & why is it important?

ESG (Environmental, Social and Governance) represents a comprehensive framework used to assess and evaluate an organization's non-financial performance and its impact. Each of the three components of ESG brings its unique focus:

- 1. Environmental (E) pertains to an organization's influence on the natural environment. This includes concerns like carbon emissions, resource conservation, waste management, pollution control, and strategies for climate change mitigation. Companies committed to corporate environmental responsibility aim to minimize their ecological footprint and reduce adverse environmental effects.

- 2. Social (S) centers on an organization's interactions with stakeholders. These stakeholders encompass employees, customers, local communities, and society at large. Social ESG embraces diverse themes such as labor practices, human rights, diversity and inclusion, employee welfare, product safety, and community engagement. Companies with a strong social responsibility strive to create positive social outcomes and address societal challenges.

- 3. Governance (G) zooms in on how an organization is structured, managed, and governed. It includes crucial elements such as board diversity, executive compensation, shareholder rights, ethical standards, transparency, and anti-corruption measures. Robust governance is essential for upholding accountability, reducing conflicts of interest, and ensuring ethical conduct within an organization. Understanding the importance of ESG in corporate governance is paramount for organizations.

Why is ESG important for companies?

- 1. Risk Management: ESG factors have emerged as significant sources of financial risk. Organizations that disregard ESG considerations may encounter regulatory fines, legal liabilities, reputational harm, and market repercussions. By addressing ESG risks, companies can mitigate these threats and safeguard their long-term sustainability.

- 2. Stakeholder Expectations: Investors, customers, employees, and regulators are increasingly scrutinizing ESG performance metrics. Meeting these expectations can enhance an organization's reputation, attract investment, and retain talent.

- 3. Competitive Advantage: Companies that embrace ESG principles can gain a competitive edge. It often benefits them in attracting and retaining environmentally conscious customers, gaining access to sustainable financing options, thereby distinguishing themselves in the market.

- 4. Long-Term Sustainability: ESG practices are integral to long-term sustainability. Through responsible environmental, social, and governance measures, organizations can minimize resource consumption, reduce risks, and ensure continued success in an evolving world.

- 5. Access to Capital: Many investors now incorporate ESG criteria into their investment decisions. Companies with strong ESG performance indicators may find it easier to access capital, enjoy lower borrowing costs, and gain increased investor confidence.

- 6. Brand and Reputation: ESG initiatives contribute to a company's brand and reputation enhancement. Demonstrating a commitment to responsible practices fosters trust among consumers and stakeholders.

- 7. Compliance and Regulation: ESG related regulations are evolving globally (discover the latest updates on ESG regulations 2023). Staying ahead of these regulatory changes ensures that an organization remains in compliance and avoids legal and financial penalties.

- 8. Innovation and Efficiency: ESG objectives often drive innovation and operational efficiency. Organizations aiming to reduce energy consumption, waste, and emissions may discover innovative technologies and processes that enhance efficiency and reduce costs.

- 9. Resilience: By addressing environmental and social challenges, organizations can bolster their resilience in the face of disruptions such as climate-related events, supply chain disruptions, and workforce challenges.

- 10. Ethical Responsibility: Many organizations consider ESG a matter of ethical responsibility. They recognize their role in creating positive societal and environmental outcomes beyond financial gain.

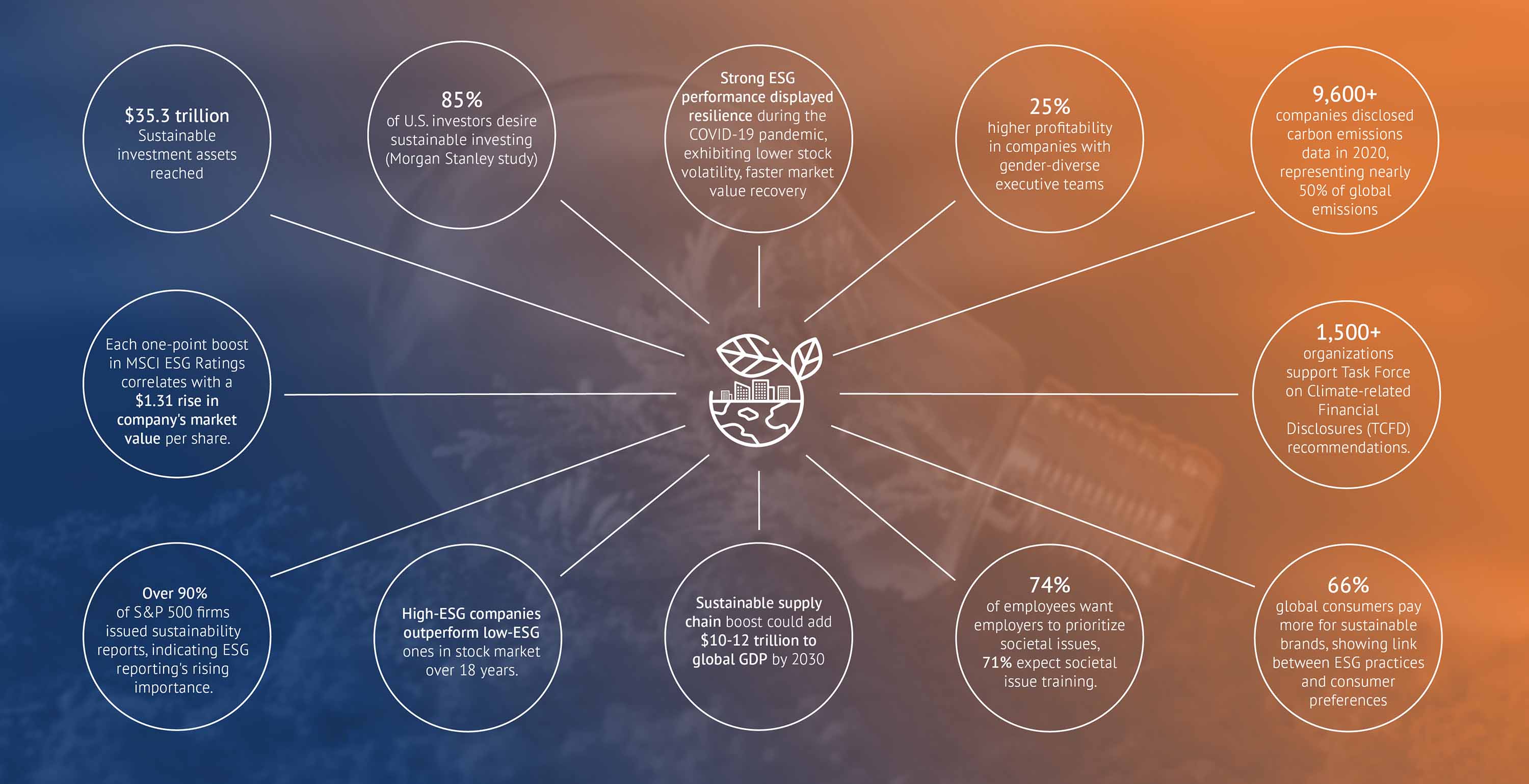

Key ESG Stats for Organizations:

In today's business landscape, Environmental, Social, and Governance (ESG) factors play a significant role in shaping corporate sustainability strategies. Understanding the latest statistics surrounding ESG performance is pivotal for organizations aiming to navigate the complexities of responsible business practices. Let us explore the key ESG metrics that help us understand ESG success and it’s contribution in creating a positive business impact and long-term value.

- 1. Sustainable investment assets reached $35.3 trillion globally in 2020, constituting 36% of total assets under management in major markets.

- 2. A Morgan Stanley study reported that 85% of U.S. investors expressed interest in sustainable investing solutions, with 95% of millennials showing interest in ESG investment options.

- 3. ESG reports by the Carbon Disclosure Project (CDP) and McKinsey & Company demonstrated that companies with strong ESG performance displayed resilience during the COVID-19 pandemic, exhibiting lower stock price volatility and quicker market value recovery.

- 4. A study by McKinsey & Company found that companies with gender-diverse executive teams in the top quartile were 25% more likely to achieve above-average profitability.

- 5. The CDP reported that over 9,600 companies worldwide disclosed their carbon emissions data in 2020, representing nearly 50% of global emissions.

- 6. As of 2020, over 1,500 organizations, including businesses, financial institutions, and governments, expressed support for Task Force on Climate-related Financial Disclosures (TCFD) recommendations.

- 7. A Nielsen survey revealed that 66% of global consumers are willing to pay more for sustainable brands, highlighting the connection between ESG practices and consumer preferences.

- 8. The Edelman Trust Barometer disclosed that 74% of employees believe their employers should prioritize societal issues, with 71% expecting their employers to provide training on ESG issues alongside other societal concerns.

- 9. McKinsey & Company estimated that improving supply chain sustainability could contribute $10 trillion to $12 trillion to global GDP by 2030. Companies with strong ESG performance often outperform their counterparts in terms of stock market performance.

- 10. Harvard Business Review reported that high-sustainability companies demonstrated significant outperformance over low-sustainability companies over an 18-year period.

- 11. In 2020, more than 90% of S&P 500 companies published sustainability reports, signalling the growing significance of benefits of ESG reporting.

- 12. Harvard Business Review discovered that a one-point improvement in MSCI ESG Ratings was associated with an increase of $1.31 in the company's market value per share.

These statistics underscore the growing importance of ESG, its tangible benefits, and its relevance in today's business landscape. ESG practices are vital for managing risks, meeting stakeholder expectations, gaining a competitive edge, and ensuring long-term success. As ESG considerations continue to evolve, organizations that prioritize ESG principles are likely to be better positioned for success in an ever-changing world.

Conclusion

ESG is important for organizations because it helps them manage risks and opportunities, meet stakeholder expectations, gain a competitive advantage, ensure long-term sustainability, access capital, enhance their brand and reputation, comply with regulations, drive innovation, and fulfill ethical responsibilities. As ESG considerations continue to grow in importance, organizations that prioritize ESG solutions will likely be better positioned for success in a rapidly changing business landscape.